Russian securities, a bit of history

Historically, Russia made massive use of the foreign capital market in the years 1860-1917 in order to develop its economy or to repay its previous loans. Many government loans or cities, were thus placed by European banks from of their clientele.

Many companies were also created in Russia with foreign capital. It can be said that at the beginning of the century the "Russian title" (bond or share) was part of the saver's standard portfolio.

Title of the Imperial Government of Russia of 1869; State loan contracted to build the railway Nicolas.

The new regime stemming from the Bolshevik Revolution (1917) did not recognize the debts contracted by the old regime and declared all these debts "null". All foreign enterprises, and thus financed by foreign capital, present on the territory were nationalized.

Thus the new regime took control of almost 15 billion Euros (600 billion FB) of assets BELGES (without interest), Decree of Lenine - February 1918.

Many small savers have found themselves ruined with many government bonds or Russian cities, or shares of Russian companies. Which explains why these titles are present in large quantities on the market of the collection.

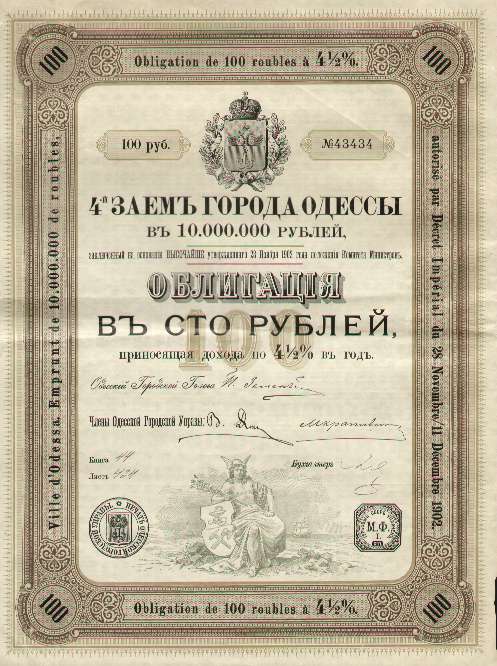

Opposite, loan of 10,000,000 rubles issued by the city of Odessa in 1902, obligation of 100 rubles.

Opposite, loan of 10,000,000 rubles issued by the city of Odessa in 1902, obligation of 100 rubles.

At the global level, the amounts are even more important. Some countries have reached an agreement with Russia to be compensated.

France, the most recent, received in 1991 400 million dollars from Russia as compensation.

Our association can also defend the interests of holders of foreign securities in other Russian.

Opposite, share issued by the company 'GEORGI ANTONOV'.