Old titles, what value?

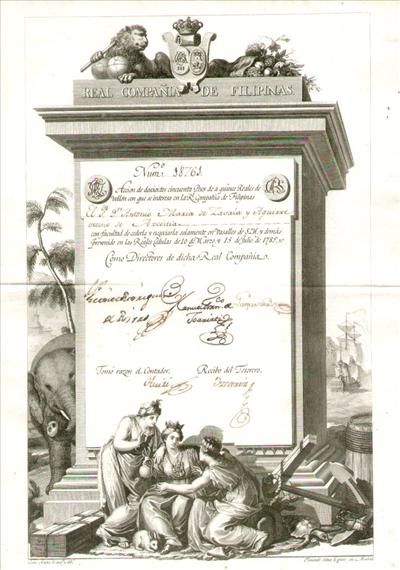

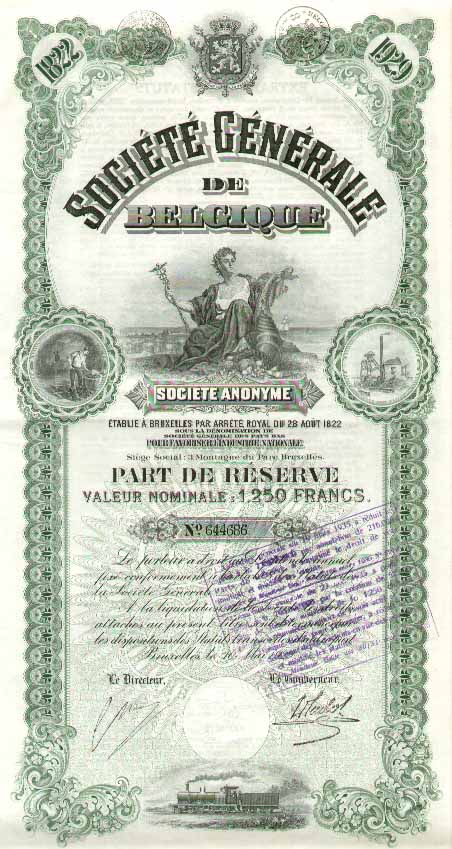

As in any collection, the price of an old stock, bond is determined by supply and demand. However one can draw up a whole series of evaluation criteria such as the age, signatures, decoration, rarity and conservation state

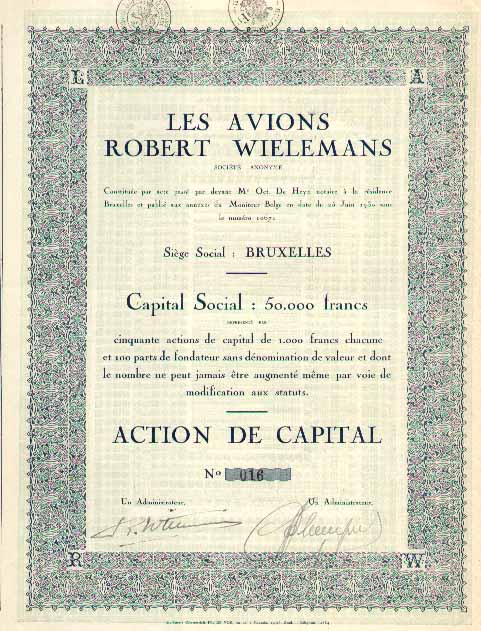

Age. The older a title, the more likely it is to have value. It must of course be put in the sense that an action of a colonization company dating from 1700 is a very old action, the oldest railway companies date from 1840, aviation and the automobile knew a further development late. Finding a colonial action of 1880 is therefore nothing exceptional, but an aviation piece of those years is much rarer.

Signatures. Independently of other factors, a share signed by a famous person has a bigger value than the one signed by an anonymous administrator. Some names found around are: Nagelmackers, Rotschild, Rockefeller, and many other famous industrialists or politicians.

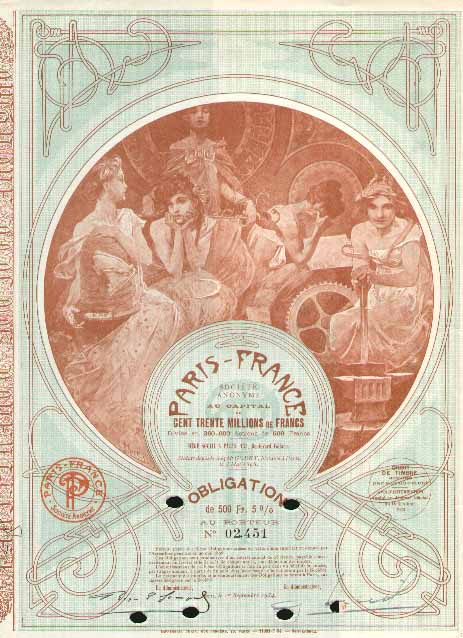

The beauty of the title. Many collectors, in addition to their theme, also collect decorative titles. These securities therefore have increased value as they affect a greater potential of buyers. It is also noteworthy that the action at the time was considered a business card of the company and that the design was neat and sometimes even entrusted to internationally known artists, such as Mucha, who signed "their work ". Stocks and bonds belonging to the "Art Nouveau" or "Art Deco" style are quite popular

The Rarity (and indirectly the number of securities issued). The smaller the quantity of securities, the more titles should be rare and therefore have value. It will be the same for the few still existing copies of a show whose majority of titles have been destroyed, after exchange or refund for example. Of course, if they arouse interest.

Thus, many titles, sometimes issued 50 copies or less, are unsaleable because have no potential buyer: they are usually titles of chemical industries, construction companies, agriculture, food, weaving, of distribution. However, some titles, even if issued in large numbers, may be considered rare. The buyer therefore reacts according to the quantity he considers to be available on the market.

The state of conservation. As in any collection, scripophilists seek quality. The ideal would be that the title is in perfect condition of freshness, like the day of its release of press. This is rarely the case . Papers that are yellow, folded, torn, chipped, stuck together, etc., lose their value. It is the same for those who stamps superimposed render illegible.

Unlike other collections, there is no price catalog for old Belgian titles. Some collectors publish from time to time a catalog containing all the titles of their theme known on the market but most of the time without any indication of rarity or price because these two notions fluctuate too much with the time to be able to be published.

It is therefore the experience that makes it possible to properly evaluate the price of a security. The past has proven that prices can fluctuate sharply upwards or downwards. The best-known example is the action "Paris-France", a magnificent color action drawn by Mucha, whose few known examples sold at the end of the 80s in the thousands of Euros until the day when the We found a whole package in a loft fund ; the action is now worth in the hundreds of Euros. And this is of course not the only known case.

On the other hand, shares that were sold in packs of 30 to 40 copies and which have gradually "landed" in collectors have thus gradually disappeared from circulation, and copies that are now occasionally found in auctions were more expensive.

The prices you could get for your actions will vary from 0 Euro (unsaleable) to several hundred Euros or even more exceptionally. However, the majority of the actions found are quite common and are trading between some Eurocents and some Euros.

As for stamps, if found in a drawer fund, it is about € 0.70 stamps in general rather than an Orval series! Finally, it should be noted that in Belgium, it is common to find trackable titles in a lot that your bank has given you and certified "worthless". We can help you where the banks are failing.